A changing landscape of cargo carriers spurred by consolidation and realignment has fueled growth at the Georgia Ports Authority by playing perfectly to GPA’s advantages.

A decade ago, ocean carriers began massive fleet upsizing to reduce fuel consumption and cost per container. This caused a major imbalance in supply and demand, particularly as the global economy fell into recession. The inability of individual ocean carriers to absorb capacity caused financial stress and led to the unprecedented carrier consolidation and alliance changes currently taking place.

The impact of consolidation has spanned the industry. Approved in December 2015, China Ocean Shipping (COSCO) and China Shipping merged into COSCO Shipping. In mid-2016, Hanjin filed for bankruptcy protection, and CMA CGM acquired APL. The merger of Hapag-Lloyd and United Arab Shipping Company (UASC) was finalized in May 2017. Maersk Line’s acquisition of Hamburg Süd should be complete by the end of 2017. The three Japanese carriers, NYK Line, MOL, and “K” Line, are establishing a new joint-venture company, the Ocean Network Express “ONE,” to integrate their container shipping businesses set to begin in April 2018. The latest development is that COSCO Shipping along with Shanghai International Port Group (SIPG) will purchase Orient Overseas Container Line (OOCL).

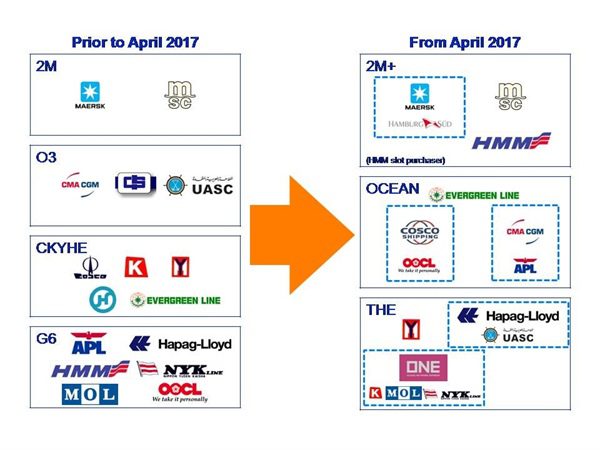

In addition to consolidation, shipping lines have been dramatically re-aligned. Previously, there were four major alliances: G6, CKYHE, Ocean Three (O3), and 2M. These were supplanted by three new alliances: THE Alliance, OCEAN Alliance, and 2M+- that began operations in April 2017. Despite the dynamic environment, and as evidence of its market strength, Georgia Ports Authority has continued to grow.

Because of its capacity for large container exchanges, GPA’s Garden City Terminal has secured 36 weekly container services, the most of any port on the U.S. East Coast. It is the largest single-terminal container port in North America, featuring 1,200 acres of space, nearly 10,000 contiguous feet of berth, 26 ship-to-shore cranes with 10 more on order, 146 rubber tired gantry cranes, and two Class 1 rail providers on-terminal. This offers ocean carriers, in any configuration, unparalleled flexibility, scalability, and efficiency from a single owner/operator in a single footprint.