Economic Development

Georgia Ranked Top State for Doing Business

Take the competitive advantage with Georgia Ports

Efficient port services and a strategic location central to the U.S. Southeast make Georgia the right choice for businesses that need effective connections to domestic and global destinations.

The Port of Savannah’s world-class speed to market, combined with long-term storage options, delivers supply chain flexibility for operators across manufacturing, retail, agriculture and logistics.

Private warehouse and distribution center development is key to facilitating the flow of cargo beyond GPA’s terminal gates, out to stores and customers. Georgia is also a hub for automotive and other advanced manufacturing. Savannah’s industrial market totals nearly 125 million square feet, with millions more under construction.

Beyond the Savannah market, the Georgia Ports Authority operates the Appalachian Regional Port in Northwest Georgia, offering access to markets in Georgia, Alabama, Tennessee and Kentucky.

GPA is also developing its second inland port near Gainesville, Ga. The Blue Ridge Connector will serve an important region for the production of heavy equipment, food and forest products.

Customers can take advantage of these inland ports to move cargo closer to destination markets by rail, reducing overall supply chain emissions compared to all-truck transit.

Georgia’s logistics infrastructure saves time and money by seamlessly connecting air, sea and land transportation. Its deepwater ports provide greater scheduling flexibility and market reach with direct interstate connections, on-terminal rail, and the most container ship services in the U.S. Southeast.

- Savannah is one of the fastest-growing ports in the nation, 100 miles closer to Atlanta than any other, and the third busiest gateway for container trade in the U.S.

- Garden City Terminal’s direct links to Interstates 95 and 16 provide efficient access to and from the port.

- At 1,500 acres, Savannah has the capacity to handle influxes of cargo, and the flexibility to handle megaships conducting massive container exchanges.

- The Mason Mega Rail Terminal, the largest on-port intermodal facility in the Western Hemisphere, is served by Class I railroads Norfolk Southern and CSX. The 85-acre facility provides ample capacity for growth, with 24 miles of on-terminal track.

Georgia is home to 35 Fortune 500 companies, including The Home Depot, UPS and Delta Airlines.

- Skilled talent — including access to the No. 1 workforce training program in the U.S., Georgia Quick Start, as well as talent from top state universities, two of which are in the top 20 public universities in the U.S. Nearly two dozen technical schools offer specialized training around the state. More than 10 colleges and universities in Georgia offer certificates, undergraduate or graduate degrees in logistics programs.

- Georgia has been rated the top state to do business based on criteria such as cost of doing business, economy, infrastructure and transportation, workforce, and access to capital. Georgia offers a business-friendly tax structure and targeted workforce training.

PORT TAX CREDIT BONUS

The Port Tax Credit Bonus can be used with either the Job Tax Credit or the Investment Tax Credit if the company 1) meets the requirements for one of those programs, and 2) increases imports or exports through Georgia deepwater ports during a specified tax year and by a specified amount.

The specified tax year is the tax year prior to the tax year in which the company wants to claim the Port Tax Credit Bonus. For example, to claim the Bonus for tax year 2024, the specified tax year is tax year 2023.

The specified amount is an increase of more than 10% from the previous tax year. This initial amount, referred to as the base amount, can be no less than the Required Port Traffic Minimums

- 75 net tons,

- 5 containers, or

- 10 TEUs (twenty-foot equivalent units)

For example, to claim the Bonus in tax year 2024, if the company generated no imports or exports through Georgia ports in tax year 2022, the company must generate more than 82.5 net tons (or 5.5 containers or 11 TEUs) in tax year 2023.

After the qualifying year, the company must maintain at least the qualifying level of port activity to continue claiming the port Bonus with Job Tax Credits during years 2 – 5. In any year the company does not maintain that qualifying level, it cannot claim the port Bonus.

The Port Tax Credit Bonus may be used to offset up to 50% of the company’s corporate income tax liability. Unused credits may be carried forward for 10 years.

Note: The Port Tax Credit Bonus cannot be used with the Quality Jobs Tax Credit.

The Port Tax Credit Bonus is subject to program requirements as outlined in O.C.G.A. § 48-7-40.15.

PORT TAX CREDIT BONUS FOR JOB TAX CREDITS

This Port Bonus is an additional $1,250 per job, per year, for up to five years for taxpayers with qualified increases in shipments through a Georgia deepwater port. The $1,250 is added to the Job Tax Credit.

PORT TAX CREDIT BONUS FOR INVESTMENT TAX CREDITS

This Port Bonus increases the Investment Tax Credit to the equivalent of a Tier 1 location regardless of the tier level at the facility location; therefore, it would be equal to 5% of the qualified investment, with the credit increasing to 8% for recycling, pollution control, and defense conversion investment.

JOB TAX CREDIT

New and expanding companies may earn Job Tax Credits (JTC) for creating new jobs in Georgia. These credits may eliminate a company’s corporate income tax liability, and in certain areas may also reduce the company’s payroll withholding obligations.

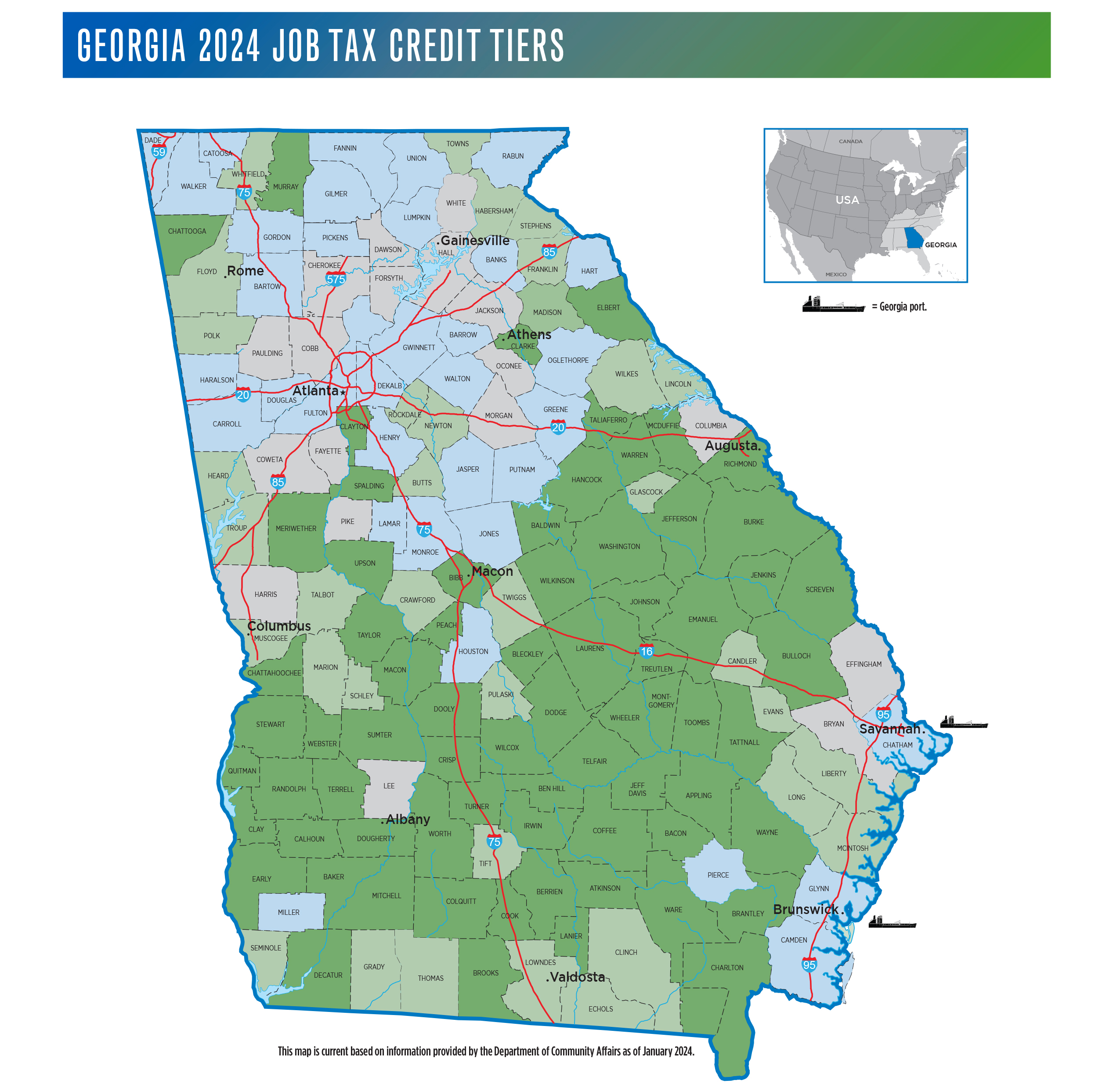

Each year, all 159 Georgia counties are assigned to one of four tiers based on the unemployment rate, per capita income, and poverty rate. A county’s tier level determines the value of the tax credits earned, the allowed uses of the credits, and the minimum number of net new full-time jobs that must be created during a single tax year to qualify. The credit value is earned for the first five years of the job’s existence as long as the job is maintained. See charts for more details.

| TIER | JOB TAX CREDIT $ (FOR 5 YEARS) |

MIN. NEW JOBS |

USE OF CREDITS** | CARRY FORWARD |

| 1 | $4,000* | 2 | 100% of tax liability – excess to withholding up to $3,500 per job |

10 years |

| 2 | $3,000* | 10 | 100% of tax liability | 10 years |

| 3 | $1,750* | 15 | 50% of tax liability | 10 years |

| 4 | $1,250* | 25 | 50% of tax liability | 10 years |

| MZ/OZ | $3,500 | 2 | 100% of tax liability – excess to withholding |

10 years |

| LDCT | $3,500 | 5 | 100% of tax liability – excess to withholding |

10 years |

QUALIFYING FOR THE JOB TAX CREDIT

To qualify, the Georgia facility must be engaged in or the headquarters of a specified industry including:

- Manufacturing

- Warehousing, Distribution, and Logistics

- Software Development

- FinTech

- Data Centers

- Contact Centers

- Telecommunications

- Research and Development Facilities

To qualify, each job must have a minimum 35-hour work week, offer health insurance benefits consistent with what is offered to existing employees, and pay more than the average wage of the county with the lowest average wage in the state ($636/week as of June 2023).

Once a project qualifies, it opens a five-year window in which each job created can earn a JTC each year for five years as long as the job is maintained. If the project creates net new jobs above the minimum threshold, a new five-year window opens.

SPECIAL ZONES

MZ = Military Zone OZ = Opportunity Zone LDCT = Less Developed Census Tract

Certain areas of the state have special designations that supersede the county tier assignment. Projects in these special zones can qualify by creating fewer jobs, may earn a higher credit value, and can use the credits in more ways.

In addition, there is no industry requirement if the project is located in one of Georgia’s 40 least-developed counties, an Opportunity Zone (OZ), or a Military Zone (MZ).

Georgia’s Opportunity Zones pre-date the federal Qualified Opportunity Zones (QOZ). The federal QOZs reward private investment with temporary deferrals of federal capital gains taxes for the investor.

For more information please visit Georgia.org/FedOZ.

Job Tax Credits are subject to program requirements as outlined in O.C.G.A. § 48-7-40, rules published by the Georgia Department of Community Affairs in Chapter 110-9.1, and the Georgia Department of Revenue in Regulation 560-7-8-.36.

Site Selection

Georgia Ports create economic activity in all of the state's 159 counties.

Find a locationCONTACT ECONOMIC & INDUSTRIAL DEVELOPMENT

P.O. Box 2406 | Phone: (912) 964-3879 | Savannah, GA 31402 | EMAIL