Economic Development

Georgia Ranked Top State for Doing Business

Delivering creative solutions

Efficient port services and a strategic location central to the U.S. Southeast make Georgia Ports an important factor in the location of industries involved in international trade. Private warehouse and distribution center development is key to facilitating the flow of cargo beyond GPA’s terminal gates, out to stores and customers. Georgia is also a hub for automotive and other advanced manufacturing. Savannah’s industrial market totals nearly 80 million square feet, with millions more under construction. Beyond that, there is enough land permitted for private development for another 100 million square feet of industrial space within 30 miles of the port.

Georgia’s logistics infrastructure saves time and money by seamlessly connecting air, sea and land transportation. Its deepwater ports provide greater scheduling flexibility and market reach with direct interstate connections, on-terminal rail, and the most container ship services in the U.S. Southeast.

- Savannah is the fastest-growing port in the nation, 100 miles closer to Atlanta than any other, and the third busiest gateway for container trade in the U.S.

- Garden City Terminal’s direct links to Interstates 95 and 16 provide efficient access to and from the port.

- At 1,345 acres, Savannah has the capacity to handle influxes of cargo, and the flexibility to handle megaships conducting massive container exchanges.

- Georgia is home to 18 Fortune 500 companies, including The Home Depot, UPS and Delta Airlines.

- Skilled talent — including access to the No. 1 workforce training program in the U.S., Georgia Quick Start, as well as talent from top state universities, two of which are in the top 20 public universities in the U.S. Nearly two dozen technical schools offer specialized training around the state. More than 10 colleges and universities in Georgia offer certificates, undergraduate or graduate degrees in logistics programs.

- Georgia has been rated the top state to do business based on criteria such as cost of doing business, economy, infrastructure and transportation, workforce, and access to capital. Georgia offers a business-friendly tax structure and targeted workforce training.

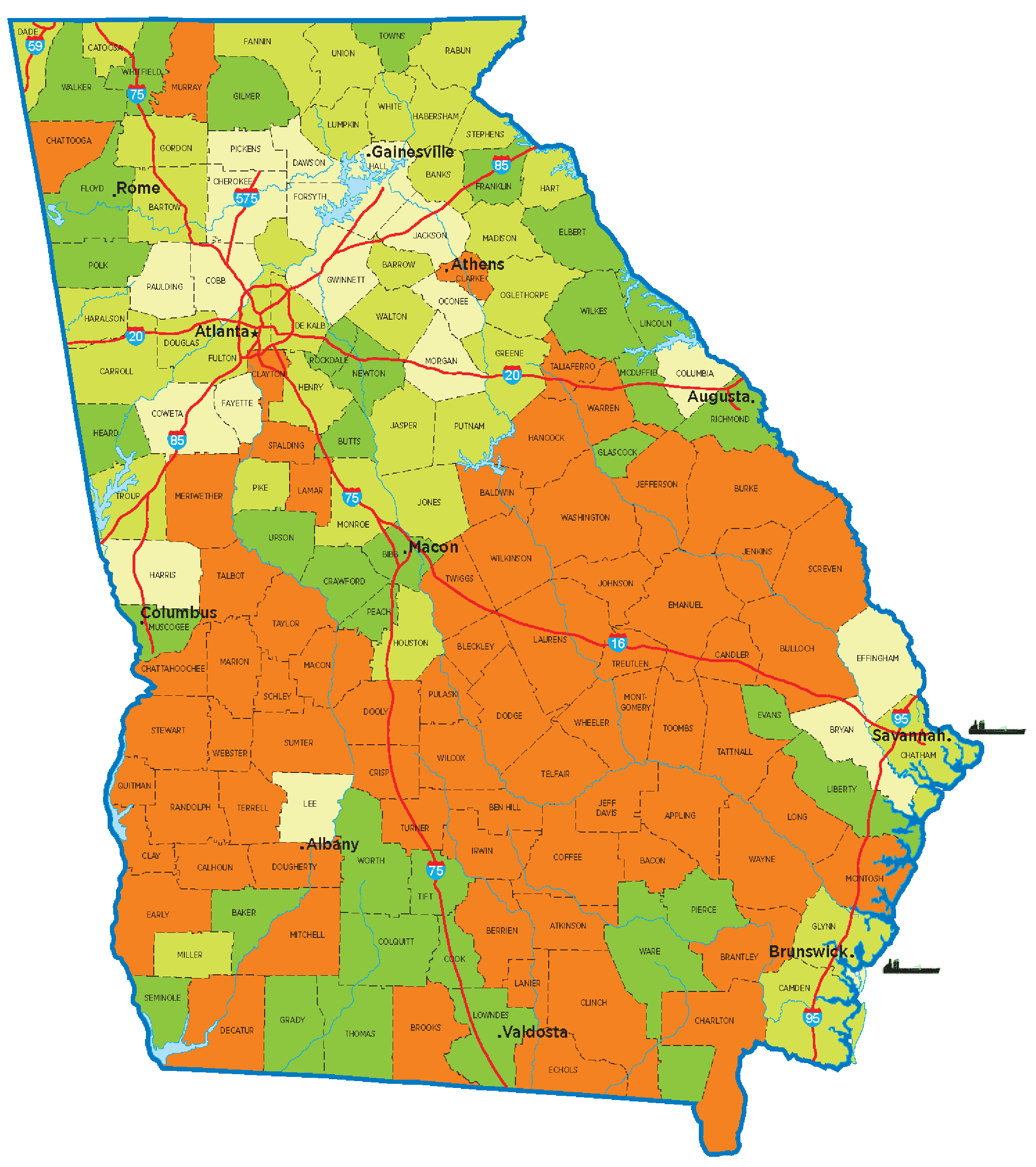

GEORGIA 2020 JOB TAX CREDIT TIERS

JOB TAX CREDIT

New and expanding companies may earn Job Tax Credits (JTC) for creating new jobs in Georgia. These credits can effectively eliminate a company’s corporate income tax liability, and in certain areas can also reduce the company’s payroll withholding obligations.

Each year, all 159 Georgia counties are assigned to one of four tiers based on the unemployment rate, per capita income, and poverty rate. A county’s tier level determines the value of the tax credits earned, and the minimum number of net new full-time jobs that must be created to qualify. The credit value is earned for the first five years of the job’s existence as long as the job is maintained.

| TIER | JOB TAX CREDIT $ (FOR 5 YEARS) |

MIN. NEW JOBS |

USE OF CREDITS** | CARRY FORWARD |

| 1 | $4,000* | 2 | 100% of tax liability – excess to withholding up to $3,500 per job |

10 years |

| 2 | $3,000* | 10 | 100% of tax liability | 10 years |

| 3 | $1,750* | 15 | 50% of tax liability | 10 years |

| 4 | $1,250* | 25 | 50% of tax liability | 10 years |

| MZ/OZ | $3,500 | 2 | 100% of tax liability – excess to withholding |

10 years |

| LDCT | $3,500 | 5 | 100% of tax liability – excess to withholding |

10 years |

SPECIAL ZONES

Certain areas of the state have special designations that supersede the county tier assignment. Companies located in these designated areas (defined above) are eligible to use excess JTCs to offset state payroll withholding liability. Additionally, all companies – regardless of industry, including retail, restaurants and services – that create at least two new eligible jobs are allowed to claim Job Tax Credits if they are located in one of Georgia’s 40 least-developed counties, an OZ or an MZ.

MZ = Military Zone OZ = Opportunity Zone LDCT = Less Developed Census Tract

Georgia’s Opportunity Zones are a state-level incentive programs that pre-dates the federal Qualified Opportunity Zones (OZ). The federal OZs reward private investment with temporary deferrals of federal capital gains taxes for the investor. For more information please visit Georgia.org/FedOZ.

TAX CREDIT CARRYOVER OPTION

Georgia companies that claimed Job Tax Credits or Quality Jobs Tax Credits for jobs created in their tax year 2016 or later now have the option of claiming jobs at pre-COVID-19 levels even if they are not able to meet the job maintenance requirement. These companies can “carry over” or use their claimed 2019 qualifying job number in lieu of their actual 2020 and/or 2021 qualifying job number when claiming their credit. The new option is just that – an option – and does not alter what the law allows for companies that create net new qualifying jobs in their 2020 and/or 2021 tax years.

QUALIFYING FOR THE JOB TAX CREDIT

A company may qualify for Georgia’s Job Tax Credit by creating net new full-time jobs at any location in the state. To qualify, the Georgia facility must be engaged in, or the headquarters of, a specified industry including:

- Manufacturing

- Warehousing, Distribution and Logistics

- Software Development

- FinTech

- Data Centers

- Contact Centers

- Telecommunications

- Research and Development Facilities

To qualify, each job must have a minimum 35-hour workweek, offer health insurance benefits consistent with what is offered to existing employees, and pay more than the average wage of the county with the lowest average wage in the state ($541/week as of June 2020).

Once a company has qualified to earn Job Tax Credits, it can earn a tax credit for each net new job it creates (and maintains) during the next five years. Each of those jobs can earn an annual credit for five years after it is created.

Each year that a company creates net new jobs above the required threshold, a new five-year cycle starts. Net new jobs created outside of a five-year cycle do not earn tax credits unless the net new jobs are above the minimum requirement to start a new cycle.

Credits may be applied to the following percentages of state corporate income tax liability:

- 50% for projects in Tier 3 and 4 counties,

- 100% for projects in Tier 2 counties, or

- 100% for projects in Tier 1 counties, Georgia OZs, MZs and LDCTs.

Once all Georgia corporate income tax liability has been satisfied, companies with projects in Tier 1 counties, Georgia OZs, MZs and LDCTs may apply any remaining Job Tax Credits against their Georgia payroll withholding liability (up to a maximum of $3,500 per job).

For all projects, any claimed but unused credits may be carried forward for 10 years from the close of the taxable year in which qualified jobs were established.

Job Tax Credits are subject to program requirements as outlined in O.C.G.A. § 48-7-40 and rules published by the Georgia Department of Community Affairs in Chapter 110-9.1 and the Georgia Department of Revenue in Regulation 560-7-8-.36.

PORT TAX CREDIT BONUS

The Port Tax Credit is a bonus that can be used with either the Job Tax Credit (JTC) or the Investment Tax Credit if the company 1) meets the requirements for one of those programs and 2) increases imports or exports through Georgia ports during a specified tax year and by a specified amount.

The specified tax year is the tax year prior to the tax year in which the company wants to claim the Port Tax Credit Bonus. For example, to claim the Bonus for tax year 2020, the specified tax year is tax year 2019.

The specified amount is an increase of more than 10% from the previous tax year. This initial amount, referred to as the base amount, can be no less than the Required Port Traffic Minimums.

- 75 net tons

- 5 containers or

- 10 TEUs (twenty-foot equivalent units)

For example, to claim the bonus for tax year 2020, if the company generated no imports or exports through Georgia ports in tax year 2018, the company must generate more than 82.5 net tons (or 5.5 containers or 11 TEUs) in tax year 2019.

After the company claims the port bonus in the qualifying year, it must maintain its port activity for each of the years claiming the associated JTC at, or above, the specified amount that first qualified it for the port bonus. If in any of those years its port activity is not maintained at that level, the company cannot claim the port bonus in that year.

Port Tax Credits may be used to offset up to 50% of the company’s corporate income tax liability. Unused credits may be carried forward for 10 years.

Note: The Port Tax Credit Bonus cannot be used with the Quality Jobs Tax Credits

Port Tax Credits are subject to program requirements as outlined in O.C.G.A. § 48-7-40.15.

PORT TAX CREDIT BONUS FOR JOB TAX CREDITS

This “port bonus” is an additional $1,250 per job, per year, for up to five years for taxpayers with qualified increases in shipments through a Georgia port. The $1,250 is added to the Job Tax Credit.

PORT TAX CREDIT BONUS FOR INVESTMENT TAX CREDITS

This “port bonus” increases the Investment Tax Credit to the equivalent of a Tier 1 location regardless of the tier level; therefore, it would be equal to 5% of the qualified investment in expenses directly related to a manufacturing or telecommunications facility with the credit increasing to 8% for recycling, pollution control and defense conversion investment. See page 9 for additional information on Investment Tax Credits.

Site Selection

Georgia Ports create economic activity in all of the state's 159 counties.

Find a locationCONTACT ECONOMIC & INDUSTRIAL DEVELOPMENT

P.O. Box 2406 | Phone: (912) 964-3879 | Savannah, GA 31402 | EMAIL